OPM Market Insights

February 2025 Edition

In our previous OPM report, we noted the existential threats that were facing OPM providers in the United States in the form of diminishing investment as well as potential regulatory action. While the investment landscape for OPMs (and edtech providers in general) has not improved, the regulatory landscape appears to be perceived as less of a risk now. In light of those existential threats, we previously noted a precipitous drop in new OPM partnership activity. In this latest report, we present full-year totals for 2024. In addition, this latest OPM report includes data related to the trend of new OPM partnership activity broken down by revenue strategy (revenue sharing vs. fee-for-service).

The OPM Market Insights Report - February 2025 Edition provides readers with best-in-class alternative market data related to this $5B industry that helps both industry and institutional stake-holders make strategic decisions in the world of online higher education.

Key Insights

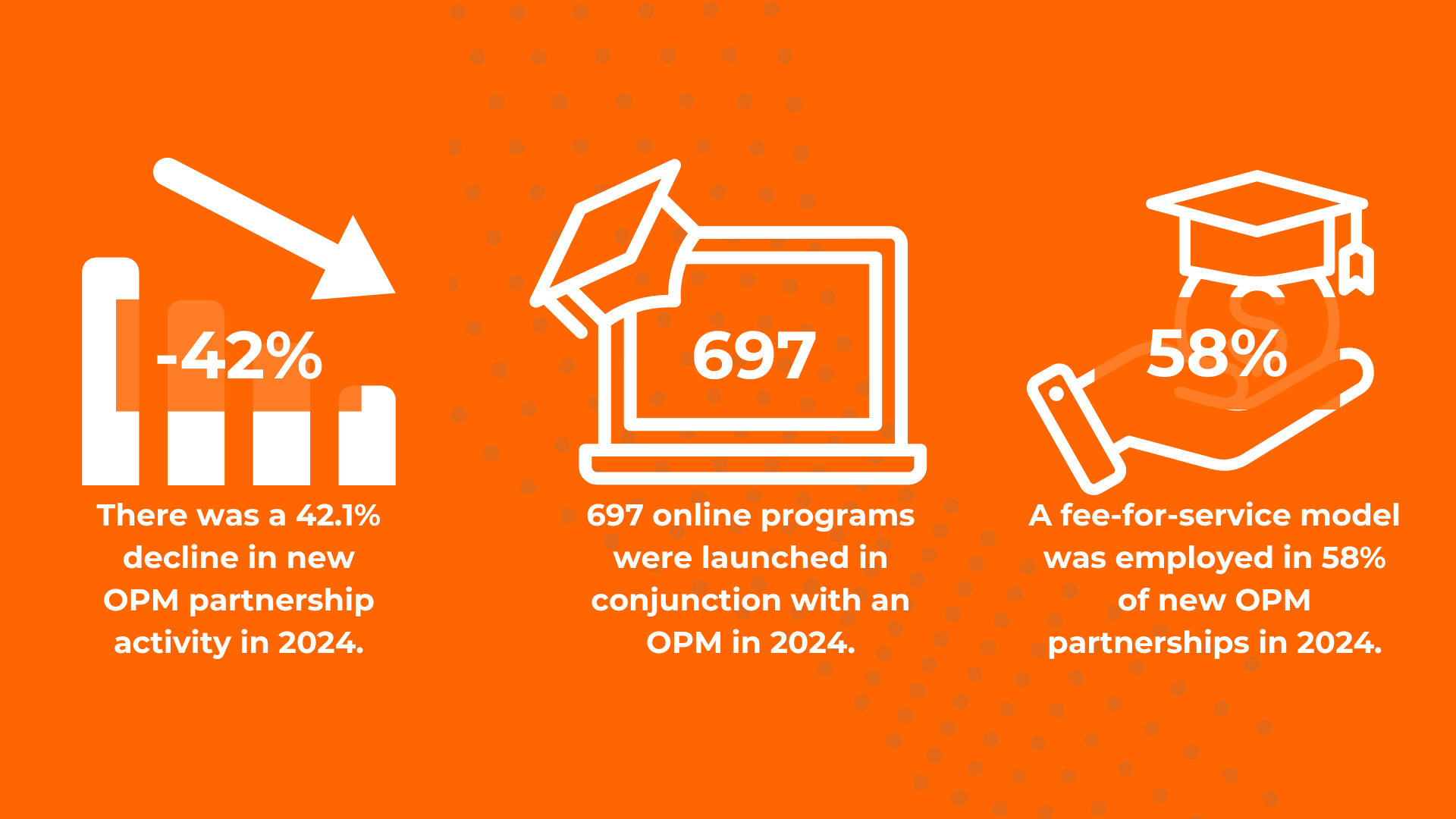

New partnership activity and new program launch activity declined to levels not observed in a decade.The second half of 2024 saw a slight rebound in new partnership activity compared to the first half of 2024. Even with the slight improvement, new OPM partnership activity ended 2024 down 42.1% year-over-year. Ultimately, 2024 saw just 81 new OPM partnerships initiated, a reversion back to levels not seen since 2016/17. New program launches were also down in 2024. For the full year, 697 new online degree or certificate programs were launched, roughly the same amount as was observed in 2015.The fee-for-service model final surpasses the revenue sharing model.While new partnership activity was down 42.1% year-over-year, there was a type of partnership that actually observed growth, and that was partnerships of the fee-for-service variety which grew 2.2% year-over-year. This model has surpassed revenue sharing as the main type of revenue strategy employed, as 58% of new partnerships established in 2024 were of the fee-for-service variety. This makes 2024 the first year on record where fee-for-service partnership activity surpassed revenue sharing partnership activity.The MBA remains the darling of OPMs.In January we published our MBA Market Report, in which we noted that while the online MBA market is indeed substantially large and growing, it is also getting very saturated. This growing saturation is causing average program sizes to decline. In spite of this, the sheer volume of students interested in this program has shown to be too appealing to pass up, as the MBA was once again the most popular online program launched by universities in conjunction with an OPM partner. The second most popular program launched by universities in conjunction with an OPM in 2024, however, was a Certificate in AI/ML.There are new market leaders in the OPM space.After publishing our previous OPM report and receiving public comments, we've updated our OPM Market Map. In addition to this updated graphic, we find that Risepoint (formerly Academic Partnerships) is now the leading OPM provider in the United States representing 11.9% of all OPM partnerships and 30.5% of all OPM-supported programs in 2024.

Actions and Reminders

The fee-for-service model has finally surpassed the revenue sharing model, and represented 58% of new OPM partnership activity in 2024. In fact, fee-for-service new partnership activity actually increased 2.2% in 2024. Much of the growth observed in this space was be either institutions utilizing OPMs for the sake of simply outsourcing marketing and recruitment or utilizing OPMs for the sake of offering specialized, often non-degree programming.

Fill out the form below to access the full whitepaper.